Services

Home / Services

Helping business owners grow to their full potential

At Greenedge Cfo, LLC, we offer a full suite of financial services designed to streamline your operations, improve your bottom line, and help your business grow. Whether you’re a small startup or an established enterprise, we provide expert bookkeeping, payroll, and advisory solutions that keep your finances in top shape.

With our team of QuickBooks Online Advanced ProAdvisors, you can trust that your financials are in the hands of experts who stay up-to-date on the latest tools and practices to keep your business running smoothly.

Let Us Handle the Numbers, So You Can Focus on Growing Your Business

From day-to-day bookkeeping to long-term financial planning, our services are designed to take the burden off your shoulders. Contact us today to learn how we can help your business thrive!

Outsourced Bookkeeping Reduces Overhead Costs And Saves Time!

Businesses that partner with a bookkeeper experience an average profit increase of 5-10%. According to a QuickBooks study, these same businesses are 2.5 times more likely to achieve growth and expansion.

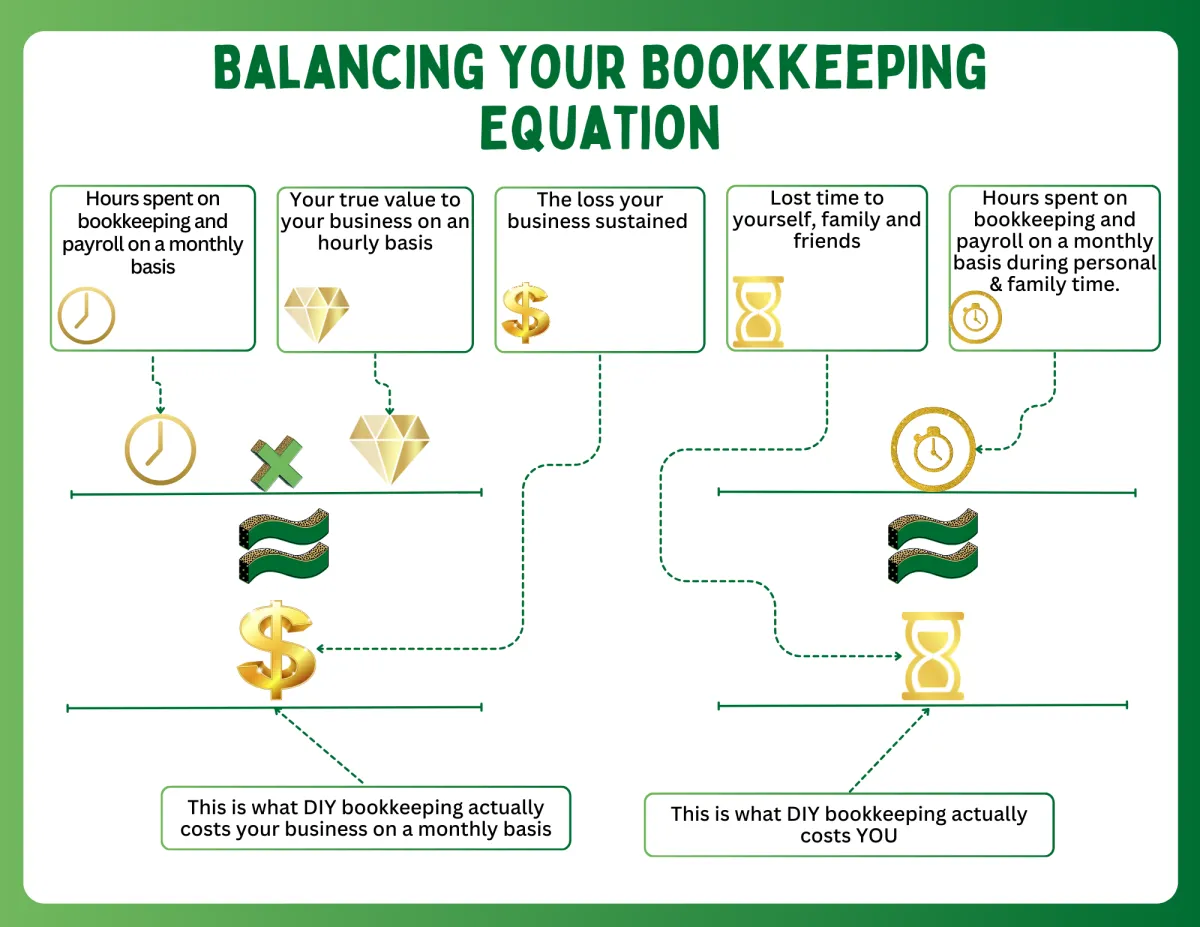

On average, small businesses spend 10-15 hours per month on bookkeeping. Mid-sized businesses invest 20-30 hours, while more complex businesses can spend 30-40 hours each month managing their finances.

Having a bookkeeper prepare for taxes ensures that your financial records are accurate and up-to-date, minimizing the risk of errors or missed deductions. This proactive approach also saves time and reduces stress during tax season by streamlining the filing process.

Bookkeeping

Bookkeeping Services

Accurate Financial Records: We keep track of all your transactions, ensuring your financial data is up-to-date, organized, and ready for tax season or any business decision-making.

Monthly Reconciliation: We reconcile your bank statements and financial accounts, helping you spot discrepancies and ensure everything aligns.

Financial Reporting: From balance sheets to profit and loss statements, we provide clear, comprehensive reports to help you understand your financial standing.

Tax Preparation Support: We work with your tax professional to ensure your books are in order, so tax filing is smooth and stress-free.

Payroll

PayRoll Service

Accurate Payroll Processing: We handle the calculation and processing of your employee wages, including overtime, bonuses, commissions, and deductions.

Tax Filing and Compliance: We ensure that all payroll taxes (federal, state, and local) are accurately calculated and filed on time, keeping your business compliant with the latest regulations.

Direct Deposit & Pay Stubs: We offer seamless direct deposit options for your employees and provide clear, detailed pay stubs for transparency.

Employee Benefits Management: From retirement plans to health insurance, we help manage employee benefits, ensuring they are deducted and processed correctly.

End-of-Year Reporting: We prepare and file year-end reports, including W-2s, W-3s, and 1099s, making tax season stress-free for both you and your employees.

Advisory

Advisory Service

Financial Strategy & Planning: We work with you to develop clear financial strategies that align with your business goals, whether you’re planning for growth, expanding operations, or managing cash flow.

Bookkeeping Process Optimization: Our team reviews your current bookkeeping practices and recommends improvements to help you save time, reduce errors, and enhance overall efficiency.

Payroll Management Consultation: We offer guidance on best practices for payroll management, from ensuring compliance with tax laws to structuring your payroll for optimal tax savings and employee satisfaction.

Cash Flow Management: We help you understand and manage your cash flow, making sure your business has the liquidity it needs to meet operational needs and seize growth opportunities.

Tax Planning & Savings: Our experts provide proactive tax planning to minimize your liabilities and maximize savings. We work closely with you to identify potential deductions and credits, helping you keep more of what you earn.

Profitability & Cost Management: We assist in identifying areas to improve profitability and reduce unnecessary costs, ensuring that your business operates at its most efficient and profitable level.

QBO Advanced Pro Advisors

Quickbooks Online Advanced Pro Advisors

Expert-Level Knowledge: As a QBO Advanced ProAdvisor, our team has in-depth expertise in QuickBooks Online’s most advanced features, ensuring your financial processes are set up correctly and run smoothly.

Customized Solutions: We understand that every business is unique. With advanced training and experience, we tailor QuickBooks to fit your specific needs, maximizing efficiency and accuracy.

Faster, More Accurate Bookkeeping: Our ProAdvisor status means we’re up-to-date with the latest QuickBooks features, integrations, and best practices, helping you avoid errors and keep your books in top shape.

Streamlined Financial Reporting: With a deeper understanding of QuickBooks Online, we can provide more detailed, actionable reports that give you valuable insights into your business's financial health.

Time Savings & Increased Efficiency: A certified QBO Advanced ProAdvisor knows how to optimize your QuickBooks setup, saving you time and reducing the need for troubleshooting. We help automate processes to make your bookkeeping more efficient.

Understanding the True Cost of DIY Bookkeeping

Let's balance your equation, Contact us today to and see what balance can do for you and your business.

2025 All Rights Reserved.